|

Here's an overview of Dominique Hanssens's thinking:

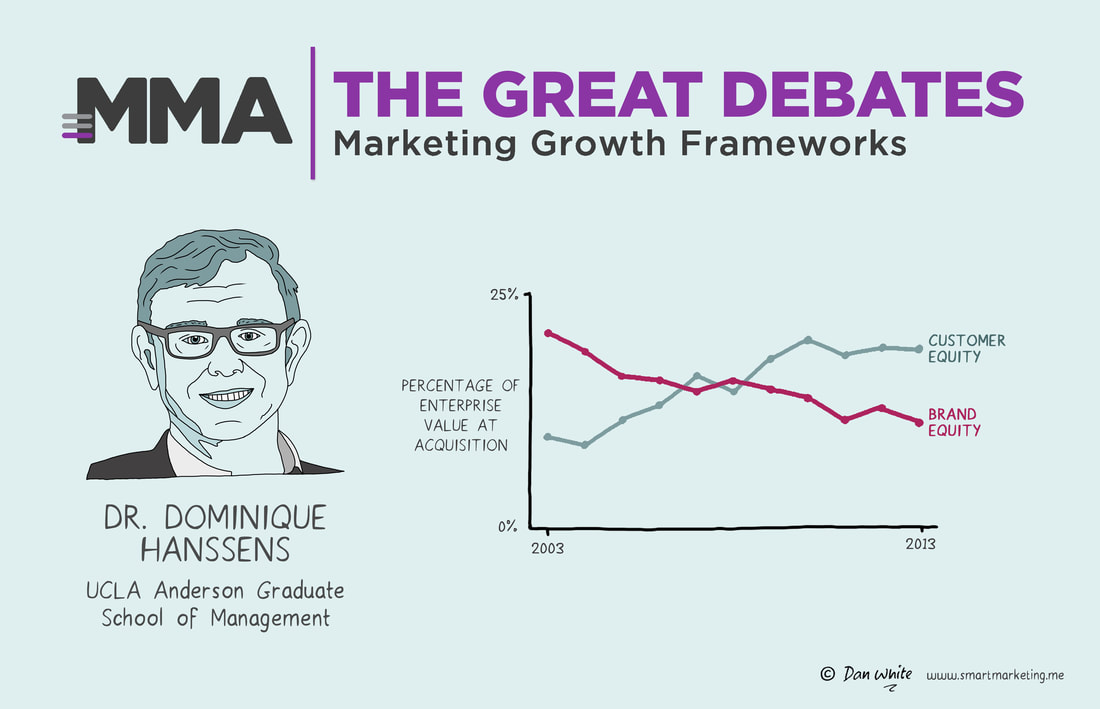

HEADLINE: Long-term growth depends on building assets that attract and retain customers over time. KEY POINTS: A meta-analysis of academic papers has shown that marketing consistently produces business results. The financial return from marketing spend is an inverted U-shape. You need to spend the right amount for maximum gain and avoid under/over-investment. Different activities can be compared in terms of their elasticities (i.e. the % change in short-term sales compared to the % change in spend): - Distribution: 0.6 to 1.7 - Sales calls 0.3 - Advertising 0.1 (higher when there is 'news' such as a new product) - Product innovation: Positive (elasticity figure hard to quantify) The same four factors relate to long-term growth although product innovation overtakes advertising in terms of its importance. Price promotion is found to have a big, short-term impact on sales, but diminishes profit, rarely has a long-term benefit and is likely to damage category profit since competitors usually respond, bringing down price expectations. The advent of widespread product reviews has made product quality and customer satisfaction more important and brand equity relatively less important (although these strongly affect each other anyway). CONSIDERATIONS: Elasticities do not reflect the relative costs of activities. E.g. doubling your distribution may not cost the same as doubling your sales calls. These differences must be factored in when comparing ROIs. Also, the effect called 'diminishing returns’ means that the additional benefit from spending more gradually decreases with higher spend levels. What to learn more? Try asking Virtual Dan White. |

- Home

- Books

-

Illustrations

- Marketing

- Brand Development

- Brand Experience

- Innovation

- Communications Strategy

- Media Characteristics

- Creative Content

- Pricing & Sales Promotion

- Measurement

- Data and Analysis

- Brand Review & Planning

- Brand Extension

- Mental Processes

- Business

- Business Story Telling

- Case Examples

- Wellbeing

- People Skills

- Life Hacks

- Articles

- Media

- Services

- Merchandise

- Contact